Lower transaction costs can lead to a virtuous cycle of increased trade volumes, better cash flow for businesses, and a surge in foreign direct investment.

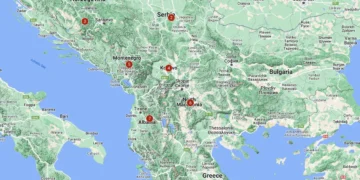

In an era where digital transformation dictates economic progress, the significance of seamless, cost-effective business transactions across borders cannot be overstated. Particularly for the Western Balkan countries, which are aspiring to intertwine more closely with each other and with the European Union, reducing the cost of international business-to-business payment transfers is crucial for economic development and integration into global markets.

Consider the plight of small and medium-sized enterprises that constitute the backbone of the Western Balkans’ economies. For these entities, often operating on razor-thin margins, exorbitant transaction fees are not just inconveniences but barriers that might deter them from engaging in cross-border trade. Lowering these costs can significantly tilt the balance, enhancing competitiveness and fostering a thriving environment where businesses can focus more on innovation and expansion rather than navigating financial hurdles.

According to a recent analysis by the World Bank, transferring 5,000 euros between small and medium-sized businesses within the Western Balkans is, on average, 10 times costlier than conducting similar transactions within the Single Euro Payments Area (SEPA). As the transaction amount increases to 20,000 euros, the cost disparity widens, with the transaction cost becoming 17 times higher than that of transfers between SEPA countries.

SEPA is an initiative that facilitates bank transfers denominated in euro by treating all euro payments within its geographic scope equally, regardless of whether they are domestic or cross-border. Its purpose is to create a seamless payment area to increase efficiency, reduce costs, and enhance competitiveness, particularly benefiting micro, small, and medium-sized enterprises by aligning payment practices and legal frameworks across participating countries, which include European Union member states and several non-European Union countries and territories.

Simultaneously, modernising the payment systems stands to offer substantial advantages for businesses within SEPA that seek to engage in trade and commerce with partners in the Western Balkans. As it stands, a company based in SEPA looking to transfer, say, 5,000 euros to a counterpart in one of the Western Balkan economies faces transaction costs that are 12 times higher than sending the equivalent payment to a counterpart in another SEPA country.

Virtuous cycle

At a macro level, the importance of facilitating inexpensive business-to-business payments extends beyond the immediate financial benefits. It’s a testament to the Western Balkans’ commitment to fostering a more integrated market. Lower transaction costs can lead to a virtuous cycle of increased trade volumes, better cash flow for businesses, and a surge in foreign direct investment. This is especially important as the Western Balkans seek ways to expedite their economic growth, bridge the development gap with Western Europe, and enhance living standards for their people.

Recognising the potential benefits, the World Bank has joined forces with various partners, including the Regional Cooperation Council and Central European Free Trade Agreement Secretariat, to provide technical assistance, which is funded by the European Union. We also stand ready to commit financing to Western Balkan economies to upgrade their domestic fast payment systems, so as to fully benefit from the opportunities provided by SEPA.

One key aspect of our assistance is to align with European Union payment regulations and other standards in order to facilitate the participation of Western Balkan economies in SEPA, thus improving market access and fostering economic integration within the region and with the European Union.

Another essential aspect of the initiative is the development and implementation of Fast Payment Systems. These systems are innovative, allowing for instantaneous money transfers 24/7, bolstered by modern features such as QR code technology and the use of proxies such as mobile phone numbers. The drive towards digitalisation is clear, and for a good reason. Research underscores the significant impact of digital financial services: a 10 per cent uptick in digital payment adoption can shrink a country’s shadow economy by approximately two per cent.

A more prosperous region

As we prepare for the upcoming Regional Western Balkans Leaders’ Summit in Montenegro later this week, it is essential to acknowledge that reducing transaction costs can make Western Balkan products and services more competitive in the European Union market. At the same time, it can also encourage businesses from the European Union and SEPA to invest and expand in the Western Balkans.

In conclusion, lowering the cost of business-to-business payment transfers between the Western Balkans and SEPA is not merely a financial incentive—it is a multifaceted strategy aimed at cultivating economic growth, integration, and stability.

It paves the way for a future where businesses, big and small, can compete on a level playing field, where innovation thrives, and where the Western Balkans can assert itself more confidently on the European and global stage.

As such, Western Balkan countries have a lot to gain from joining SEPA and modernising payment systems. The payoff—a more prosperous, integrated, and stable region—is well worth the endeavour.